August 13, 2007

The New Chrysler : GlobalGiants.com

Photo: Dancers from Project Bandaloop descend from atop Chrysler’s headquarters building during an employee event celebrating the first day of The New Chrysler on Monday, Aug. 6, 2007, in Auburn Hills, Mich. More than 8,000 employees watched as a banner was unfurled telling the world to “Get Ready for the Next 100 Years.”

The New Chrysler marked the start of a new era by bringing back its Pentastar corporate logo, announcing a new corporate advertising campaign and staging a celebratory rally for thousands of employees on the lawn outside its company headquarters. The “First Day” events followed the August 3 contract signing under which New York-based Cerberus Capital Management assumed majority ownership of the company, with former owner DaimlerChrysler AG maintaining a significant minority stake.

Photo: Chrysler Headquarters.

The Pentastar, which for decades symbolized Chrysler Corporation, is back as the corporate mark for The New Chrysler. |GlobalGiants.com|

Posted by Editors at 04:14 AM

July 30, 2007

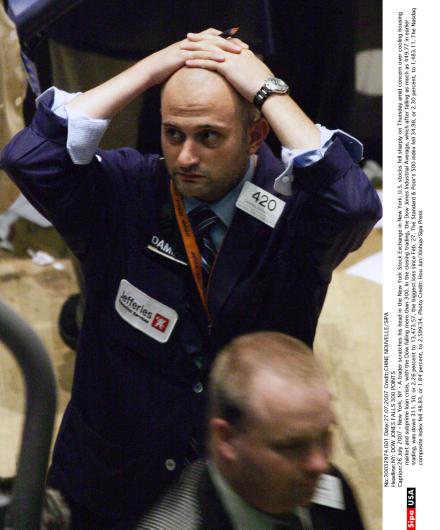

Credit Worries Continue on Wall Street : GlobalGiants.com

Stocks in New York continue to fluctuate on Monday but demonstrate some signs of stabilizing.

A trader scratches his head in the New York Stock Exchange in New York. U.S. stocks fell sharply on Thursday amid concern over cooling housing market and subprime loan crisis, with the Dow falling more than 300. Photo Credit: Hou Jun/Xinhua/Sipa

Posted by Editors at 02:18 PM

July 24, 2007

BANK OF AMERICA RECEIPT : GlobalGiants.com

Photo: Bank of America ATMs: Making Deposits Has Never Been Easier; Checks are Scanned, Cash Counted, and Receipts Display Digital Images of Deposited Checks and Cash. (Photo Credit: Bank of America, Michael Lobiondo)

Bank of America, which has the largest bank-owned ATM network in the USA and the most ATMs that accept deposits, began rolling out the new ATMs last year. Currently the ATMs are available in the Carolinas, Atlanta, Chicago, Los Angeles, Miami, New York, Phoenix, Portland (OR), Riverside, San Diego and Washington D.C. markets. |GlobalGiants.com|

Posted by Editors at 01:58 PM

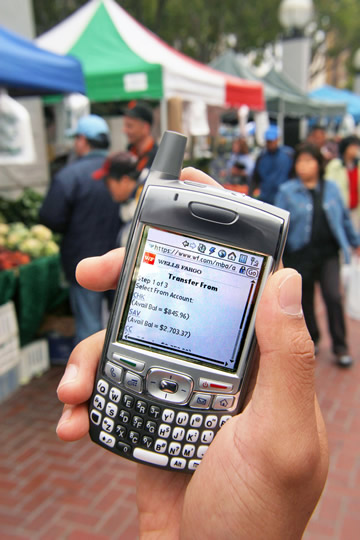

Wells Fargo Launches Mobile Banking : GlobalGiants.com

Photo: A shopper participating in a pilot program transfers money between his bank accounts using the new Wells Fargo Mobile banking solution on a mobile device, Wednesday, July 18, 2007, at an outdoor market in San Francisco. Launched nationwide USA on July 24, 2007, Wells Fargo Mobile allows customers with a browser-based mobile device to check account balances, view transaction histories and transfer money between Wells Fargo accounts. (Photo for Wells Fargo by Court Mast)

SAN FRANCISCO, July 24 -- Wells Fargo & Company (NYSE:WFC) announced the launch today of Wells Fargo Mobile(SM), a browser- based mobile banking solution, available to all of its customers nationwide USA. With this new service, Wells Fargo allows its customers to access their Wells Fargo financial relationship through a web browser on their mobile device. |GlobalGiants.com|

Posted by Editors at 01:50 PM

July 17, 2007

Dow Jones Industrial Average Crosses 14,000 for the First Time : GlobalGiants.com

A trader keeps working after the ringing of the closing bell on Wall Street in New York City on July 16, 2007. The Dow closed at over 13,950 and set a new all time record. (UPI)

The stock market’s best-known indicator crossed 14,000 in the first half-hour of trading on Tuesday morning, rising to 14,002.60, having taken just 57 trading days to make the trip from 13,000. |GlobalGiants.com|

Posted by Editors at 12:56 PM

July 09, 2007

Neiman Marcus & Bergdorf Goodman Select Marquis Jet as Exclusive Private Jet Partner : GlobalGiants.com

Upscale Offering for Retailers' Affluent Consumers.

NEW YORK, July 9 -- The Neiman Marcus Group, comprised of Neiman Marcus and Bergdorf Goodman retailers, and Marquis Jet(SM), the leader in private jet cards, today announced an alliance providing their respective clientele with a broad range of exclusive benefits.

The Marquis Jet Card program provides the convenience, quality and safety of NetJets(R), the worldwide leader in fractional jet ownership, 25 hours at a time. InCircle members who purchase their first 25 hour Marquis Jet Card will receive a co-branded Marquis Jet / InCircle Jet Card that will provide many special benefits, beginning with 100,000 InCircle points. Going forward, Neiman Marcus / Bergdorf Goodman and Marquis Jet will participate in a number of joint marketing programs benefiting their respective clientele, including special event access and exclusive in-store and online offers. |GlobalGiants.com|

Posted by Editors at 09:01 AM

July 04, 2007

TRITON ATM : GlobalGiants.com

Photo: Triton's FT7000, a full-function, through-the-wall ATM for financial institutions, features an envelope depository and an expansion bay for future upgrades such as check scanning. Available in a walk-up or drive-up configuration, the FT7000 is fully XFS compliant and runs Triton's Prism(TM) ATM software with Diebold 912 Emulation support, assuring seamless integration and compatibility into any existing network. Triton is a global ATM manufacturer and the largest provider of off-premise ATMs in North America. (Triton) |GlobalGiants.com|

Posted by Editors at 05:13 AM

June 13, 2007

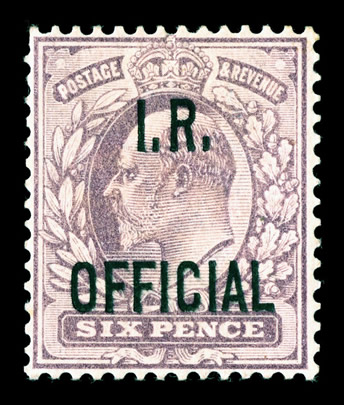

STANLEY GIBBONS STAMP : GlobalGiants.com

Photo: The 1904 6d 'IR Official', Great Britain's rarest stamp, which sold for a record $360,000 yesterday. Illustration courtesy of Shreves Philatelic Galleries, Inc. (Stanley Gibbons) |GlobalGiants.com|

Posted by Editors at 01:45 PM

June 11, 2007

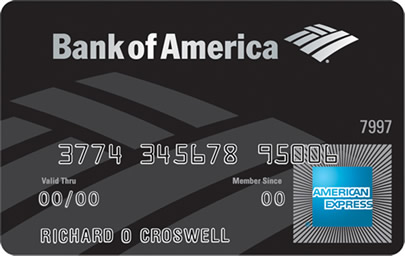

Bank of America Delivers First Premium Credit Card Designed Exclusively for its Wealthy and Affluent Clients : GlobalGiants.com

New Bank of America Accolades(TM) American Express(R) Card Offers Distinctive Perks and Benefits.

BOSTON, June 11-- Bank of America today introduced the Bank of America Accolades(TM) American Express(R) card, the first premium credit card designed exclusively for Bank of America's affluent, wealthy and ultra- wealthy clients served through Premier Banking & Investments(TM), The Private Bank of Bank of America and its extension, Family Wealth Advisors. |GlobalGiants.com|

Posted by Editors at 01:45 PM

June 10, 2007

ING DIRECT: FAMED DAREDEVIL FLIES 150 FEET OVER MOUNTAIN OF MONEY : GlobalGiants.com

Photo: Kaptain Robbie Knievel, son of legendary daredevil "Evel" Knievel, soars 150 feet over a heaping mountain of money representing the $4.6 billion in interest ING DIRECT customers have earned since 2000. His big leap was part of the ING DIRECT Independence Ride 2007, a full-day event which took place in Wilmington, DE on Saturday, June 9th. In addition to the jump, the event included a 60-mile motorcycle ride with more than 1000 riders and a performance by the Steve Miller Band. The event raised $75,000 for the Muscular Dystrophy Association. (Photo courtesy of ING DIRECT) |GlobalGiants.com|

Posted by Editors at 01:38 PM

June 05, 2007

Chinese Stocks Rebound After Extremely Volatile Morning : GlobalGiants.com

Photo: An investor sits in front of the stock price index at a securities company in Chengdu, in southwest China's Sichuan province, 05 June 2007. Chinese share prices closed 2.63 percent higher 05 June after an extremely volatile day that saw the market plunge by as much as seven percent in morning trade, dealers said. AFP PHOTO/LIU Jin |GlobalGiants.com|

Posted by Editors at 12:20 PM

June 01, 2007

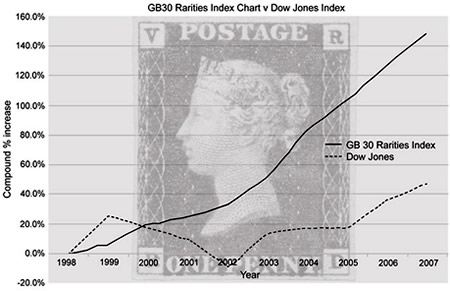

STANLEY GIBBONS CHART : GlobalGiants.com

Photo: Chart showing returns of 150% available from investing in rare Great Britain stamps and the outperforming of the GB30 Rare Stamp Index against the Dow Jones over the last 10 years. (Stanley Gibbons)

Legendary investor Bill Gross will be auctioning part of his multi-million US$ stamp collection for charity on June 11. The stamps are expected to sell for US$5million, a 150% increase on the initial purchase price. Stanley Gibbons Limited, the world's oldest and most respected name in stamps, will be there in New York holding seminars showing investors how to achieve 150% returns investing in rare stamps.

All proceeds from the auction are being generously donated to Medecins Sans Frontieres/Doctors Without Borders, the international independent medical humanitarian emergency aid organisation. The auction emphasises the worth of rare stamps as an alternative investment vehicle. |GlobalGiants.com|

Posted by Editors at 02:40 AM

May 30, 2007

Bush to Name Former Deputy Secretary of State as World Bank President : GlobalGiants.com

Photo: Robert Zoellick, a nimble negotiator who has crisscrossed the globe as President Bush’s trade chief and as the country’s No. 2 diplomat, is the White House’s choice to be the next World Bank President.

Bush will announce the decision on Wednesday, according to a senior administration official. |GlobalGiants.com|

Posted by Editors at 01:56 PM

May 23, 2007

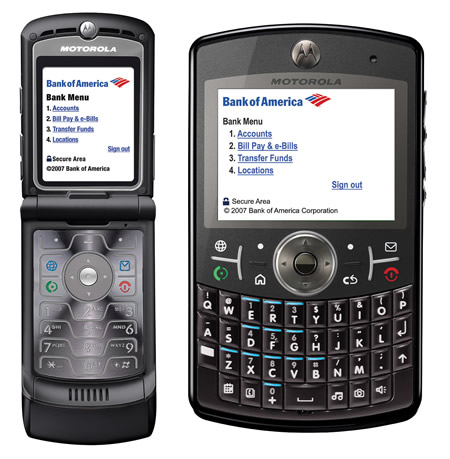

Bank of America's Mobile Banking Now Available Anytime, Anywhere to More Than 20 Million Online Customers Across the U.S. : GlobalGiants.com

Completion of Rollout Gives Bank of America Customers Ability to Manage Their Finances 'On the Go' Through Cell Phones and Smartphones.

Bank of America has completed the rollout of its secure Mobile Banking service -- enabling more than 20 million Online Banking customers to manage their personal finances 'on the go.' Consumers across the USA now can use their cell phones and smartphones to check account balances, pay bills and transfer money.

Bank of America began rolling out Mobile Banking service to consumers in March and now is providing the service to more than 20 million online customers across the country. Using the Web browser built into most current cell phones or smartphones, consumers can:

• Check balances on their checking, savings and credit card accounts, as

well as mortgages and home equity lines held with Bank of America.

• Pay their bills and e-bills.

• Transfer money between accounts and to other Bank of America customers.

• View transactions for checking and savings accounts, mortgages and home

equity lines, including posted and pending transactions.

Mobile banking from Bank of America is secure. Customers are protected with the bank's SiteKey (R) security service, as well as its Zero Liability Online Banking Guarantee. To help protect customer information, the bank has developed a unique end-to-end security feature that ensures information remains encrypted when sent between the mobile phone and the bank. |GlobalGiants.com|

Posted by Editors at 02:21 AM

May 18, 2007

President of the World Bank, Paul Wolfowitz, Resigns : GlobalGiants.com

Photo: Paul Wolfowitz resigned as president of the World Bank on Thursday, ending a protracted battle over his stewardship prompted by his involvement in a high-paying promotion for his companion. |GlobalGiants.com|

Posted by Editors at 12:30 PM

May 14, 2007

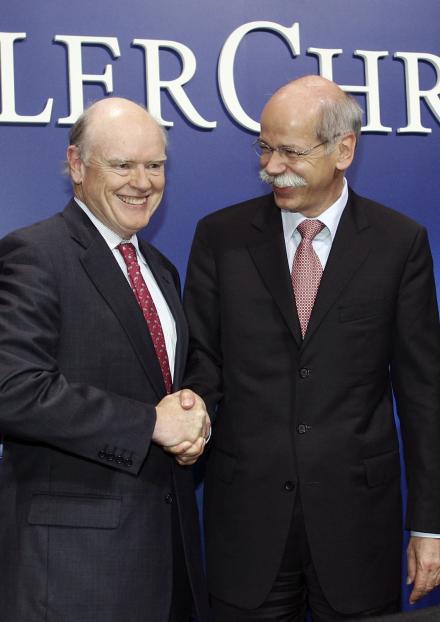

Chrysler Sold to Cerberus Capital Management for $7.4 Billion : GlobalGiants.com

Photo: DaimlerChrysler CEO Dieter Zetsche (R) and John W. Snow (L) Chairman Cerberus Capital Management shake hands during the Daimler Chrysler press conference on May, 14 2007 in Stuttgart, Germany. German-US auto giant DaimlerChrysler said on Monday it had agreed to sell control of its loss-making US arm Chrysler to private equity firm Cerberus, for 5.5 billion euros or 7.4 billion dollars. (Getty Images) |GlobalGiants.com|

Posted by Editors at 12:43 PM

April 24, 2007

Citi Announces Plant-A-Tree Program to Help Drive Environmental Awareness : GlobalGiants.com

Encourages Customer Enrollment in Paperless Statements.

Announces First Quarter Success With More Than 300,000 Trees Planted.

NEW YORK, April 24 -- Citi, the leading global financial services company, is aiming to help make a difference in the environment this year, while delivering tangible benefits to customers who desire to reduce their dependence on paper and help to protect the environment. In January, the company put in motion a customer-focused "Plant- a-Tree" initiative - a program that creates environmental awareness by encouraging its credit card holders to switch to paperless statements, planting a tree for each conversion made. Today, the company announced its first quarter results from the program, where already more than 300,000 customers have opted to "go paperless" and just as many trees have been planted on their behalf nationwide.

For every customer that switches to paperless statements, Citi, in partnership with the National Arbor Day Foundation (NADF), will plant a tree on his or her behalf in a location where it is most needed. Along with the environmental benefits, going paperless has its consumer advantages as well. Going paperless helps reduce paper clutter and allows customers to view their statements online for up to six months, as well as provides easy access to account activity anywhere, anytime.

Citi, the leading global financial services company, has some 200 million customer accounts and does business in more than 100 countries. |GlobalGiants.com|

Posted by Editors at 01:26 PM | Comments (0)

March 07, 2007

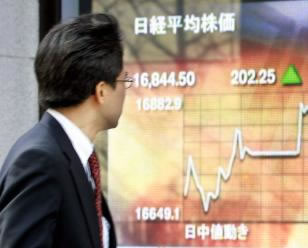

JAPAN STOCKS : GlobalGiants.com

Asian markets rebound.

Photo: A pedestrian passes in front of a share prices chart in downtown Tokyo, 06 March 2007. Japanese share prices rebounded 202.25 points to close at 16,844.50 points at the Tokyo Stock Exchange, clawing back some of their heavy recent losses as bargain hunters emerged after five straight days of falls. AFP PHOTO / Yoshikazu TSUNO (Photo credit YOSHIKAZU TSUNO/AFP/Getty Images) |GlobalGiants.com|

Posted by Editors at 01:55 AM | Comments (0)

February 27, 2007

Standard Chartered Greatest Race on Earth (GROE) 2006/07 : GlobalGiants.com

US$1.5million up for grabs as the finale of The Greatest Race on Earth draws near.

Hong Kong hosts the final leg of The Greatest Race on Earth.

Hong Kong — Another strong men's and women's line-up has been announced for the fourth and final leg of The Standard Chartered Greatest Race on Earth (GROE) 2006/07, the Hong Kong Marathon, which will take place on 4 March. With teams separated by the tightest of margins after the previous races of the series in Nairobi, Singapore and Mumbai, the final marathon will determine how the largest prize pool in world athletics, US$1.5 million, is ultimately shared.

The Greatest Race on Earth (GROE) was created in 2004 - the first-ever virtual relay race across four marathons. The Main Team Challenge category is open to men and women over 18 years of age, of any nationality, with no restriction on the level of competence. Each team member will run in one marathon. Teams must nominate who will run in each full marathon before the start of the series, and the winning team will be the one whose athletes record the lowest aggregate time across the four marathons.

In 2005/06 the quality of the runners was world-class, with 24 male and 30 female GROE runners placing in the top 10 of each of the four marathons.

Building on the success of the first two series, Standard Chartered presents GROE for the third time. There are over 80 teams and 300 participants taking part. The race covers marathons in Nairobi, Singapore, Mumbai and Hong Kong, representing some of the most challenging environments in the world:

• The highest race at over 1,600 metres in Nairobi – 29 October 2006

• The island race around Singapore – 3 December 2006

• The historic race through Mumbai – 21 January 2007

• The harbour race across Hong Kong – 4 March 2007

|GlobalGiants.com|

Posted by Editors at 02:44 AM | Comments (0)

February 21, 2007

INVITATION TO ITAU DAY AT NYSE : GlobalGiants.com

Photo: From left to right: Banco Itau's corporate headquarters, view of NYSE, and invitation to Itau Day at NYSE. (NewsFoto: Banco Itau Holding Financeira S.A.) |GlobalGiants.com|

Posted by Editors at 04:03 AM | Comments (0)

December 19, 2006

MasterCard Launches the MasterCard(R) rePower(TM) Prepaid Load Network

InComm Successfully Processes First POS Transaction.

PURCHASE, N.Y., Dec. 19 -- MasterCard Worldwide and InComm today announced the successful completion of the first cardholder point of sale transaction using the MasterCard rePower Load Network. MasterCard rePower at the point of sale is a new service that allows consumers to add money to eligible MasterCard or Maestro branded prepaid cards at participating merchant locations. InComm will begin offering the solution to the 145,000 stores that comprise its retail distribution network.

MasterCard rePower allows MasterCard-branded prepaid cardholders to easily add money to their eligible prepaid accounts at participating retail locations, bringing a valuable service to the millions of financially "underserved" individuals in the United States. Prepaid cards have emerged as a key enabler of allowing those without a banking history -- a segment that research firm Celent estimates to be 14 million households -- to forge a relationship with a financial institution and better manage their money.

Eligible cardholders need only to present a participating merchant with an eligible MasterCard or Maestro-branded reloadable prepaid card, along with the money they wish to add. The merchant uses standard transaction codes and transmits the load amount. The transaction is processed in real-time over the MasterCard network, giving the cardholder immediate access to his or her money.

Posted by Editors at 11:01 PM

December 18, 2006

Citigroup, Mastercard, Cingular and Nokia team to pilot next generation mobile phone.

"tap & go(TM)" payment in New York City.

Innovative Payment Trial to Use Near Field Communications Technology.

NEW YORK, NY - Citigroup, MasterCard Worldwide, Cingular Wireless and Nokia today announced a consumer technology trial of Near Field Communication (NFC)-enabled mobile phones with MasterCard PayPass(TM) contactless payment capability in New York City. The goal of this trial is to evaluate the speed and convenience that "tap and go" payments made through mobile phones can provide to Citi credit cards and Cingular customers in the New York City area. The trial is expected to run three to six months.

Pre-selected Citi MasterCard cardholders with Cingular Wireless accounts are participating in the trial and will receive Nokia NFC-enabled mobile phones with MasterCard PayPass payment functionality. MasterCard PayPass is a "contactless" payment program that provides consumers with a fast and convenient way to pay.

"As a leader in innovative products and services, Citigroup continually looks for ways to make the lives of our customers easier," said Amy Radin, Chief Innovation Officer, Global Consumer Group, Citigroup. "We are confident that mobile phone technology with contactless payment will appeal to our customers' increasing demands for speed, convenience and security."

Cingular Wireless is the largest wireless carrier in the United States. Citigroup (NYSE: C), the leading global financial services company, has some 200 million customer accounts and does business in more than 100 countries. MasterCard develops and markets payment solutions and processes more than 16 billion payments each year. Nokia is a world leader in mobile communications.

Posted by Editors at 07:30 PM

December 15, 2006

AMERICAN EXPRESS MEMBERSHIP REWARDS PROGRAM: ICE CUBE COLLECTION

PHOTO: The Chopard 18K white gold and diamond "Ice Cube Collection" Ladies Bracelet Watch is one of the rewards as part of the just-launched First Collection - a distinctively elegant collection of boutique-style, premium offers exclusively available to American Express Platinum Card(R) and Centurion(R) Card members through the Membership Rewards program from American Express.

Posted by Editors at 12:15 PM

December 04, 2006

The Bank of New York Company, Inc. and Mellon Financial Corporation Agree to Merge

Create the Global Leader in Securities Servicing and Asset Management.

Merger Combines Highly Complementary Businesses Positioned for Strong Global Growth.

NEW YORK and PITTSBURGH, Dec. 4 -- The Bank of New York Company, Inc. (NYSE:BK) and Mellon Financial Corporation (NYSE:MEL) announced today they have entered into a definitive agreement to merge, creating the largest securities servicing and asset management firm globally.

PHOTO: Tom Renyi, Chairman and CEO of The Bank of New York, and Bob Kelly, Chairman, President and CEO of Mellon.

The new company, which will be called The Bank of New York Mellon Corporation, will be the world's leading asset servicer with $16.6 trillion in assets under custody and corporate trustee with $8 trillion in assets under trusteeship, and will rank among the top 10 global asset managers with more than $1.1 trillion in assets under management.

Thomas A. Renyi, currently chairman and chief executive of The Bank of New York, will serve as executive chairman of The Bank of New York Mellon Corporation for 18 months following the close of the transaction with overall responsibility for the integration of the two companies.

Robert P. Kelly, currently president, chairman and chief executive officer of Mellon, will serve as chief executive officer of the new company and will succeed Mr. Renyi as chairman of the board. Gerald L. Hassell, currently president of The Bank of New York, will hold the same position in the new company. The board of directors will comprise 10 members designated by The Bank of New York and eight members designated by Mellon. The new company's headquarters will be based in New York City while maintaining a strong and growing presence in Pittsburgh.

Mr. Renyi said: "We are creating one of the world's leading financial services growth companies. Both our companies focus their businesses in highly attractive sectors of the financial services industry. Together, we will be the global leader in securities servicing, and one of the top providers of asset and wealth management worldwide. Together, we will have the scale, the technology, the capital, and the people we need to compete and win in the rapidly expanding global marketplace."

Mr. Kelly said: "The merger creates an extraordinarily strong and rapidly growing global competitor in our core businesses. Through this merger, we will be able to invest and expand more effectively than any of our competitors due to our combined scale, profitability and global reach. The organic growth of our respective companies is already strong, and the cost savings and revenue synergies opportunities are excellent. Together, we will have the best service in the world, strong investment performance and the highest fiduciary standards."

Mr. Renyi continued: "We will be fully focused on delivering the high quality service our customers deserve as we create rewarding opportunities for our employees and superior returns for our shareholders. In addition, our balanced business mix and widespread geographic diversification will position us to move and manage our clients' assets with the proven expertise and experience that few global companies can match."

Mr. Kelly added: "Today's action is clearly in the best long-term interests of our customers, shareholders and employees, as well as the city of Pittsburgh, where we will increase our very strong commitment to the community. We expect Pittsburgh to be home for several business divisions, as well as making it a center of excellence for technology, operations and administration."

Under the terms of the agreement, The Bank of New York's shareholders will receive 0.9434 shares in the new company for each share of The Bank of New York that they own and Mellon shareholders will receive one share in the new company for each Mellon share they own. The Bank of New York and Mellon have entered into mutual stock option agreements for 19.9% of the issuer's outstanding common stock.

The transaction has been unanimously approved by each company's board of directors and is expected to be completed early in the third quarter of 2007, subject to regulatory and shareholder approvals. Assuming the achievement of planned synergies, on a GAAP basis the transaction is expected to be 1.0% dilutive to The Bank of New York's operating earnings in 2007, and 1.4% accretive in 2008; it will be 1.0% accretive to Mellon's operating earnings in 2007, and 5.7% accretive in 2008. On a cash basis, which excludes the impact of non-cash items such as the amortization of intangibles, the transaction is expected to be 1.1% accretive to The Bank of New York's earnings in 2007, and 5.3% accretive in 2008; it will be 4.5% accretive to Mellon's earnings in 2007, and 11.9% accretive in 2008.

The combined company today has annual revenues of more than $12 billion, with approximately 28% derived from asset servicing, 38% from issuer services, clearing services and treasury services, and 29% from asset management and private wealth management. It will be well positioned to capitalize on global growth trends, including the evolution of emerging markets, the growth of hedge funds and alternative asset classes, the increasing need for more complex financial products and services, and the increasingly global need for people to save and invest for retirement. Almost a quarter of combined revenue will be derived internationally. With a combined pro forma market capitalization of approximately $43 billion, The Bank of New York Mellon Corporation would become the 11th largest U.S. financial institution.

The companies expect to reduce total pre-tax costs by approximately $700 million per year, or approximately 8.5% of the estimated 2006 combined expense base. The integration will be undertaken by a dedicated and experienced group of senior executives in a thoughtful and deliberate manner over a three year period following the close of the transaction. The transaction will involve restructuring charges of approximately $1.3 billion.

The companies' combined employee base of 40,000 is expected to be reduced by approximately 3,900 over a three-year period following the transaction. The companies will reduce headcount through normal attrition wherever possible and will provide extensive support to employees impacted by the merger.

The Bank of New York was represented in the transaction by the investment banking firm of Goldman Sachs and the law firm of Sullivan & Cromwell. Mellon was represented by the investment banking firms of UBS Investment Bank and Lazard and the law firms of Simpson Thacher & Bartlett LLP and Reed Smith LLP.

The Bank of New York Company, Inc. is a global leader in providing a comprehensive array of services that enable institutions and individuals to move and manage their financial assets in more than 100 markets worldwide. The Company has a long tradition of collaborating with clients to deliver innovative solutions through its core competencies: securities servicing, treasury management, asset management, and private banking. The Company's extensive global client base includes a broad range of leading financial institutions, corporations, government entities, endowments and foundations. Its principal subsidiary, The Bank of New York, founded in 1784, is the oldest bank in the United States and has consistently played a prominent role in the evolution of financial markets worldwide. The Company has $12.2 trillion in assets under custody and more than $179 billion in assets under management. Additional information is available at http://www.bankofny.com/.

Mellon Financial Corporation is a global financial services company. Headquartered in Pittsburgh, Mellon is one of the world's leading providers of financial services for institutions, corporations and high net worth individuals, providing asset management, private wealth management, asset servicing, payment solutions and investor services. Mellon has approximately $5.3 trillion in assets under management, administration or custody, including $918 billion under management. News and other information about Mellon is available at http://www.mellon.com/.

Posted by Editors at 07:46 PM

December 01, 2006

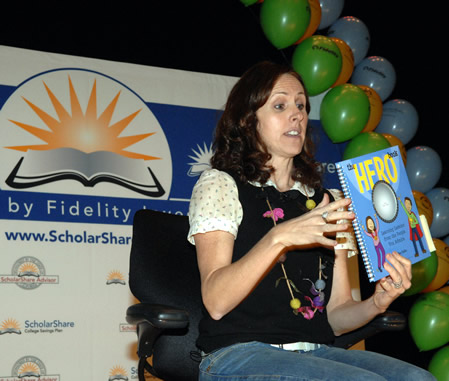

FIDELITY INVESTMENTS SCHOLARSHARE COLLEGE SAVINGS PROGRAM

Photo: Actress Molly Shannon reads "The Hero Book" by Ellen Sabin to McKinley Elementary School second graders to celebrate the launch of the California ScholarShare College Savings Program, Thursday, Nov. 30, 2006 in Los Angeles. Fidelity Investments manages California's tax-advantaged 529 college savings plan. Photo by Susan Goldman. (PRNewsFoto/Fidelity Investments, Susan Goldman)

Posted by Editors at 10:03 PM

FIDELITY INVESTMENTS SACRAMENTO BALLET

Photo: Sacramento Ballet cast member Megan Horton, who dances the part of the Sugarplum Fairy, answers questions from elementary school students after she read the Nutcracker to them in Sacramento, Calif., on Thursday, Nov. 30, 2006. ScholarShare, the State of California's 529 college savings program, and Fidelity Investments hosted the special children's reading event at the studios of the Sacramento Ballet. The event celebrates the recent launch of the California ScholarShare College Savings Program which promotes the importance of getting an early start in saving for college. (PRNewsFoto/Fidelity Investments, Steve Yeater)

Posted by Editors at 09:58 PM

November 28, 2006

New York Stock Exchange: Argentine Corporate Day

NEW YORK, Nov. 27 -- Leading Argentine companies traded in the United States took part in the first "Argentine Corporate Day" held at the New York Stock Exchange headquarters.

PHOTO: Argentine companies ringing the opening bell at the Argentine Corporate Day at the New York Stock Exchange.

The event was attended by the main executives -- CEOs, CFOs, and directors -- of major companies from Argentina, representing a broad spectrum of economic activity, notably, Banco Hipotecario, Banco Macro, Cresud, IRSA, Metro Gas, Telecom Argentina, Tenaris and TGS.

The purpose of the gathering was to reinforce the presence of Argentine companies in the international market, in view of the growing interest that this country has been awakening among investors.

During the day, executives presented the main development projects of their companies at a press conference and in meetings with investors.

The day began at the New York Stock Exchange with the traditional opening bell, the signal for the start of trading, initiated by Argentine executives, followed by a large press conference with the international and Argentine media.

During a luncheon prior to the schedule of meetings with investors, the Argentine executives, together with representatives from banks, investment funds and government authorities, attended a panel titled "Argentina: Business Prospects for 2007".

The event included participation from three panelists: Sergio Berensztein (Director of Di Tella University), Gustavo Canonero (Deutsche Bank New York) and Walter Molano (BCP Securities). The panelists emphasized Argentina's considerable growth and good prospects as reflected in social and economic indicators.

Posted by Editors at 03:37 PM

November 16, 2006

Paige Davis Brings Touch of Holiday Cheer to Jewel Osco Grocery Shoppers in Chicago

Pay By Touch Partners With TV and Broadway Star to Give Chicagoans an Early Holiday Gift.

CHICAGO, Nov. 16 -- Pay By Touch(R), the leader in integrated biometric authentication, personalized marketing and payment solutions has joined forces with Paige Davis, formerly of TLC's "Trading Spaces," to kick-off the holiday season for Chicagoans.

The "Touch of Holiday Cheer" program is being launched on Nov. 17, 2006 by Pay By Touch and Davis, who will visit a local Chicago Jewel Osco grocery store to surprise random shoppers by paying for their groceries.

The Pay By Touch service uses a simple finger scan to authorize an electronic withdrawal from a customer's existing checking account. Each fingerprint is unique, which helps prevent fraud or identity theft, and since there is nothing to carry, there is nothing to be lost or stolen. The one-time enrollment in the secure program takes only a few minutes to complete at participating stores.

Posted by Editors at 02:19 PM

US AIRWAYS PROPOSES TO MERGE WITH DELTA

Transaction Valued at Approximately $8.0 Billion in Cash and Stock.

Consumers Will Have the Advantages of a Larger, Full-Service Provider with the Cost Structure of a Low-Fare Carrier.

US Airways Group, Inc. (NYSE: LCC) announced yesterday that it has made a merger proposal to Delta Air Lines, Inc. (OTC: DALRQ.PK) under which both companies would combine upon Delta’s emergence from bankruptcy. The proposal would provide approximately $8.0 billion of value in cash and stock to Delta’s unsecured creditors.

PHOTO: US Airways proposes an $8 billion takeover of bankrupt Delta Airlines on November 15, 2006. (Kamenko Pajic/UPI Photo)

The combination of US Airways and Delta would create one of the world’s largest airlines and would operate under the Delta name. Customers would benefit from expanded choice as well as the reach and services of a large-scale provider within the cost structure of a low-fare carrier. As a combined company, the “New” Delta would be the number one airline across the Atlantic and the second largest airline to the Caribbean. The New Delta would reach more than 350 destinations across five continents, including North and South America, Europe, Asia and Africa. In the U.S., the combination would create a leading competitor in the Eastern U.S. and an enhanced position in the Western U.S. The combined company would be the number one airline at 155 airports.

Posted by Editors at 09:29 AM

October 09, 2006

SAP and SWIFT to Drive Simplicity and Insight in Corporate Banking

Collaboration on Corporate-to-Bank Connectivity to Enable Seamless Payment Processing.

Integration of mySAP(TM) ERP and SWIFTNet to Create Single Connection for Multiple Corporate Accounts to Lower TCO and Improve Financial Insight.

WALLDORF, Germany, Oct. 9 -- SAP AG (NYSE:SAP) and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) today announced plans to help alleviate the complexity and cost incurred by companies worldwide in managing a multitude of separate communication channels for each bank relationship. SAP and SWIFT have joined forces to introduce the SAP(R) Integration Package for SWIFT -- a standardized software solution that will be designed to link SAP ERP solutions directly to SWIFTNet, the IP-based messaging platform connecting nearly 8,000 financial institutions in 206 countries and territories. The announcement was made at Sibos, the world's premier financial services event, being held in Sydney, Australia, October 9 - 13.

"With SAP Integration Package for SWIFT, SAP and SWIFT are making it easier and more cost-efficient for corporate clients to exchange payment, cash management and treasury information with their banks," said Johan Kestens, head of Marketing and member of the Executive Committee of SWIFT. "Banks and corporates can now enjoy the security and reliability of SWIFT, leverage SWIFTStandards for easier processing and integrate with SAP ERP systems. It is a win-win situation for everybody."

SAP is the world's leading provider of business software. Today, more than 34,600 customers in more than 120 countries run SAP(R) applications-from distinct solutions addressing the needs of small and midsize enterprises to suite offerings for global organizations.

Posted by Editors at 02:03 PM

September 15, 2006

Lucky Race Fan Earns Spot as Honorary Grand Marshal for the Bank of America 500 at Lowe's Motor Speedway

Bank of America to provide fans with greater access to the sport and to personal banking with inaugural race sponsorship.

Past champions of the October race to be honored during pre-race program.

Racing fan and Columbus, North Carolina resident Mickey Jackson, and five-year-old son, Kalob, earned the once-in-a-lifetime opportunity to deliver the 'gentlemen, start your engines' command live at this year's Bank of America 500. Bank of America today announced Mickey as the winner of the Bank of America 500 Honorary Grand Marshal contest, a consumer promotion supporting the company's title sponsorship of the October 14 race at Lowe's Motor Speedway.

For winning the contest, Mickey earns the title of "Honorary Grand Marshal" of the Bank of America 500 and the opportunity to deliver the race- start command, a VIP experience on race day for him and a guest, including pit passes, seats in Bank of America's newly created, exclusive fan section in the fourth turn terrace at Lowe's that provides access to a private food court, food and beverage vouchers - and a gift pack of Bank of America 500 racing merchandise.

"Never in my life did I think I would have the chance to start a NASCAR race under the lights at Lowe's Motor Speedway," said Mickey Jackson, a carpenter from Columbus, NC. "Standing before thousands of passionate fans and an even larger national television audience to start the Bank of America 500 is any racing fan's dream come true."

Bank of America is one of the world's largest financial institutions, serving individual consumers, small and middle market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk-management products and services.

Posted by Editors at 05:33 AM

April 01, 2006

This is Citigroup.

Since 2002, Citigroup has been running a new brand campaign with a new tagline, “This is Citigroup.”

The world’s largest financial company unveiled its new image through a global campaign that showcases the unparalleled capabilities of this vast and unique business. TV and print ads appeared in the United States, Europe, Latin America and Japan.

Citigroup Inc. is today’s pre-eminent financial services company, with some 200 million customer accounts in more than 100 countries.

Other major brand names under Citigroup's trademark red umbrella include Citi Cards, CitiFinancial, CitiMortgage, CitiInsurance, Primerica, Diners Club, The Citigroup Private Bank, and CitiCapital.

Shot in 17 cities, in eight countries on five continents, the campaign features a series of five moving and beautiful television spots along with four complementary print executions from Citigroup’s advertising agency Merkley Newman Harty|Partners (MNH|P), New York. The advertising challenge was to communicate the multiple parts of the Citigroup story (a diverse product portfolio, global reach, deep roots and stability) in a singular, powerful message.

Each ad emphasizes one or more core strengths that, bound together with the new tagline, tell the complete Citigroup story. Each commercial concludes with a compelling fact, followed by the simple yet definitive, “This is Citigroup.” This clear and consistent theme not only appeared in every ad but also in other corporate vehicles such as the cover of Citigroup’s 2001 and 2002 Annual Reports and on the company Web site, www.citigroup.com.

Posted by Editors at 01:45 PM