« GM and Chrysler Transaction is the Best Alternative to Preserve Jobs and Cash: Grant Thornton | Main | The Cost of GM's Death: Automotive News's Warning to the US Federal Government »

November 16, 2008

Global Association of Risk Professionals Provides Financial Risk Manager Certification Exams to Nearly 14,000 Candidates Around the World

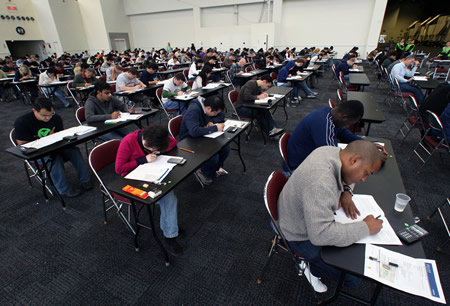

Photo: In New York's Jacob K. Javits Convention Center, November 15, several hundred financial risk manager certification candidates taking the 6-hour Financial Risk Manager (FRM(R)) Exam offered by the Global Association of Risk Professionals (GARP).

Yesterday, on November 15, at 9 am local time in each of 78 cities around the world, a record-breaking total 13,681 financial professionals were registered to take the annual Financial Risk Manager (FRM(R)) certification exam offered by the Global Association of Risk Professionals. From New York to Hong Kong, the 6-hour exams were taken at testing centers located in major cities across six continents including Mumbai, Beijing, Jakarta, Tokyo, Singapore, Seoul, Bangkok, London, Paris, Warsaw, Frankfurt, Istanbul, Dublin, Stockholm, Tel Aviv, Dubai, Melbourne, Sydney, Johannesburg, Montreal, Toronto, Dallas, Seattle, Honolulu and many others.

The Global Association of Risk Professionals (GARP) is a not-for-profit independent association of close to 100,000 risk management practitioners and researchers representing banks, investment management firms, government agencies, academic institutions, and corporations from more than 167 countries worldwide.

There were 500 candidates registered to take the exam in New York, 1,700 in Hong Kong and 1,100 in Mumbai, reflecting the significant and growing global attention to the practice of financial risk management," said Richard Apostolik, GARP President and CEO. "FRM certification has become the gold standard for financial risk managers to objectively demonstrate real world competence in their profession, and the FRM certification program is helping to expand industry-wide understanding of financial risk management best practices, concepts and theories," he added.

|GlobalGiants.com|

Edited & Posted by the Editor | 2:40 AM | Link to this Post