« World Economic Forum: Leaders Rally for a 'Great Reset' to Achieve Global Goals | Main | Amazon Announces New Shopping Experience — “Luxury Stores” »

October 2, 2020

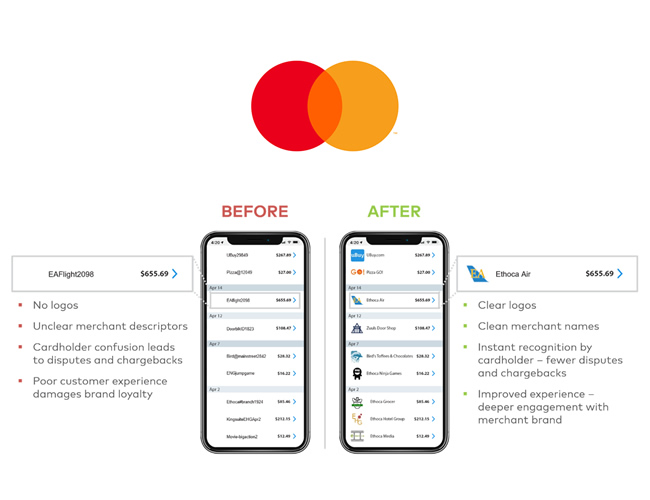

Mastercard Delivers Greater Transparency in Digital Banking Applications

Purchase, NY | September 30, 2020 —Mastercard collaborates with merchants and financial institutions to include logos in digital banking applications.

As more businesses turn to digital payments, and the number of connected devices grows, one thing is becoming increasingly clear: consumers are demanding more clarity around what they bought and who they bought it from, Mastercard said.

Almost everyone has experienced the frustration of trying to decipher confusing and brief purchase descriptions when reviewing online statements. This confusion forces cardholders to contact their banks unnecessarily to dispute unrecognized transactions, adding extra steps for consumers and generating an array of costs for merchants and banks, Mastercard explained.

A new initiative from Mastercard and managed by Ethoca, the company’s collaborative fraud and dispute resolution technology, aims to eliminate this confusion and improve the customer experience. Mastercard encourages all merchants to upload their logos at Ethoca for inclusion in online banking and payment apps. The merchant logos will be linked to corresponding transactions, adding clear visual cues to help cardholders quickly identify legitimate purchases. Participating merchants can simultaneously extend their brand presence as well as eliminate expensive and time-consuming chargebacks. This program is also available to all financial institutions, Mastercard added.

According to Mastercard, a recent Ethoca-commissioned Aite Group study of the US market revealed that 96% of consumers want more details to recognize purchases easily. Global chargeback volume may reach 615 million by 2021, fueled in large part by frustrated consumers turning to the dispute process unintentionally.

“With greater digital dependency, having real-time purchase details is critical for consumers, merchants, and card issuers alike,” said Johan Gerber, executive vice president, Cyber and Security Products at Mastercard. “We continue to collaborate with industry partners to bring clarity and simplicity before, during, and after transactions. By enriching transaction details, merchants can alleviate friendly fraud, reduce chargebacks, and improve the customer experience.”

This endeavor is part of comprehensive efforts to deliver the most efficient, safe, and simple payment experience from the minute a consumer begins browsing to once they’ve made the purchase, Mastercard stated.

Source: Mastercard

|GlobalGiants.Com|

Edited & Posted by the Editor | 6:43 AM | Link to this Post