« U.S. Secretary of State Blinken and Indian External Affairs Minister Dr. S. Jaishankar delivered Remarks and participated in a Conversation at Howard University in Washington, D.C. | Main | Finance Minister of India, Nirmala Sitharaman, meets IMF Managing Director Ms. Kristalina Georgieva in Washington D.C. »

April 15, 2022

IMF Chief addresses the International Monetary Fund 2022 Spring Meetings Curtain Raiser

Photo: Post Spring Meetings 2021, Head of Department Meetings Chief of Staff, Dominique Desruelle, looks on during the post-2021 Spring Meetings meeting with the department heads at the International Monetary Fund. Washington, DC, United States. Image provided by & copyright © IMF Photo/Cory Hancock. [File photo]

Photo: IMF Managing Director Kristalina Georgieva meets with Queen Máxima of the Netherlands at the International Monetary Fund on March 23, 2022. Washington, DC, United States. Image provided by & copyright © IMF Photo/Cory Hancock.

Photo: Supply Chain and Inflation. There are high gas prices at gas stations in the Washington, DC, metropolitan area. January 19, 2022. Washington, DC, United States. Image provided by & copyright © IMF Photo/Cory Hancock.

Washington, DC, April 15, 2022 — The IMF’s Managing Director Kristalina Georgieva raised the 2022 Spring Meetings curtain yesterday, April 14, in an event hosted by Carnegie Endowment for International Peace. The IMF MD stated that the world is facing a crisis on top of an emergency: First, the pandemic, and second, Russia’s invasion of Ukraine.

Global growth prospects vary significantly across countries: from catastrophic economic losses in Ukraine to a severe contraction in Russia to countries facing spillovers from the war through commodity, trade, and financial channels, IMF said. IMF will release detailed forecasts in the World Economic Report next Tuesday.

“The outlook has deteriorated substantially, largely because of the war and its repercussions. In addition, inflation, financial tightening, and frequent, wide-ranging lockdowns in China causing new bottlenecks in global supply chains are also weighing on activity. As a result, we will be projecting a further downgrading global growth for 2022 and 2023. Fortunately for most countries, growth will remain in positive territory. That said, the impact of the war will contribute to forecast downgrades for 143 economies this year, accounting for 86 percent of global GDP,” said Georgieva.

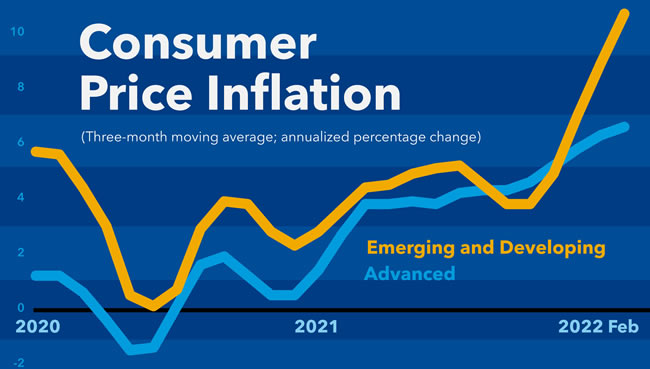

Photo: Consumer Price Inflation Chart. Source: IMF.

Emerging and developing economies face the added risk of potential spillovers from monetary tightening in advanced economies—higher borrowing costs and capital outflows.

“The Russian invasion of Ukraine triggered spillovers through three main channels. The first is commodity prices, wheat oil, gas, and metals. The second one is the pressure on inflation and the necessity for central banks to tighten up faster than they would otherwise with all the consequences for emerging markets. And the third one is the financial channels remittances and the impact on how the monetary system will look after the war. So when you look at this impact from a human standpoint, the most dramatic one is food prices. Why? Because that comes on top of already deepening food insecurity in many parts of the world. Remember, we had bad harvests in several countries, locusts in Africa, and the Horn of Africa that have already generated pressure. And now the war is heating on the world’s low-income families even more,” added Georgieva.

Georgieva concluded the event by stressing that the international community’s immediate priorities are to end the war in Ukraine, confront the pandemic, and tackle inflation and debt.

“2020 is the record highest borrowing year since World War II. Even the global financial crisis didn’t lead to such an expansion of borrowing in one year. Now, when we have a global debt level of 256% of global GDP, we have to think of its impact. Interest rates are low. In some cases, even negative, this is easy. In fact, in 2021, debt went up, but debt service in many countries went down. Why? Because of accommodative monetary policy. When inflation accelerated, I should say that part of the inflation pressure came from demand picking up after the pandemic. Still, supply chains are getting broken, and supply is not catching up with this demand. Price stability is essential for growth, so central banks have to take action. They have to act decisively. Interest payments go up when they do so, and servicing debt becomes much more difficult,” the IMF MD concluded.

The world’s financial leaders are set to meet in Washington, DC, next week for the IMF and World Bank Spring Meetings.

Rising inflation, the economic impact of the war in Ukraine, and the lingering effects of the pandemic are front and center for policymakers.

Source: International Monetary Fund (IMF)

|GlobalGiants.Com|

— The editor holds certification in “Financial Market Analysis” from International Monetary Fund, Washington, DC.

Edited & Posted by the Editor | 1:05 PM | Link to this Post