« Natural Diamond Council presents Jewellery Trend Report saying "Maximalism" is the Flavour of the Season | Main | Ducati Lenovo Team ready to hit the track in Austin, Texas, for the Americas GP »

April 11, 2023

IMF announces World Economic Outlook April 2023

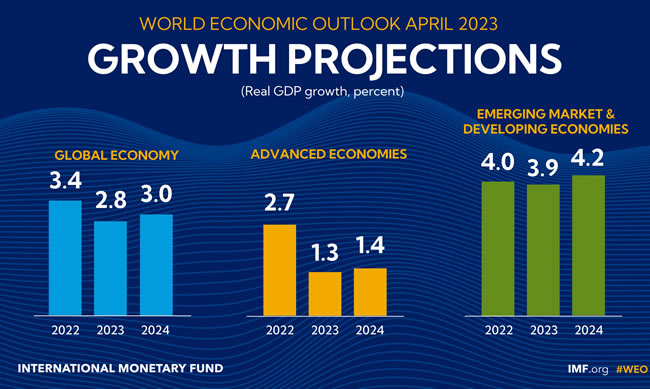

Washington DC, April 11, 2023 — In its World Economic Outlook’s press briefing, the IMF (International Monetary Fund) announced today that the baseline forecast for global output growth is 0.1 percentage points lower than that predicted in the January 2023 WEO Update. It would rise to 3.0 percent in 2024.

“The world economy is still recovering from the unprecedented upheavals of the last three years, and the recent banking turmoil has increased uncertainties. As a result, we expect global output growth to fall from 3.4% last year to 2.8% in 2023 before rising to 3% in 2024, mostly unchanged from our January projections. Advanced economies would see an especially pronounced growth slowdown from 2.7% in 2022 to 1.3% in 2023. Global headline inflation is set to fall from 8.7% in 2022 to 7% in 2023 due to lower commodity prices, but underlying core inflation is proving to be stickier. Importantly, this outlook assumes that recent financial stresses remain contained,” said Pierre-Olivier Gourinchas, the IMF’s Chief Economist.

Much uncertainty clouds the short- and medium-term outlook as the global economy adjusts to the shocks of 2020-22 and the recent financial sector turmoil. As a result, recession concerns have gained prominence, while worries about stubbornly high inflation persist.

“Once again, risks are heavily tilted to the downside. They have risen with the recent financial turmoil. Most prominently, recent banking system turbulence could result in a sharper and more persistent tightening of global financial conditions. The simultaneous rate hikes across countries could have more contractionary effects than expected, especially as debt levels are at historical highs. There might be a need for more monetary tightening if inflation remains stickier than expected. These risks and more could all materialize at a time when policymakers face much more limited policy space to offset negative shocks, especially in low-income countries,” added Gourinchas.

With the fog around current and prospective economic conditions thickening, policymakers have a narrow path toward restoring price stability while avoiding a recession and maintaining financial stability. However, achieving strong, sustainable, and inclusive growth will require policymakers to stay agile and be ready to adjust as information becomes available.

“First, as long as financial stress is not systemic as it is now, the fight against inflation should remain the priority for central banks. Second, central banks should use separate tools to safeguard financial stability and clearly communicate their objectives to avoid unwarranted volatility. Further, financial policies should remain laser-focused on preserving financial stability and watch for any buildup of risks in banks, non-banks, and the real estate sectors. Third, in many countries, fiscal policy should tighten to ease inflation pressures, restore debt sustainability, and rebuild fiscal buffers. Finally, in the event of capital outflows that raise financial stability risks, emerging market and developing economies should use the integrated Policy framework, combining temporary targeted foreign exchange interventions and capital flow measures where appropriate,” said Gourinchas.

The International Monetary Fund (IMF) lowered India’s economic growth projection for the current fiscal to 5.9 percent from 6.1 percent earlier. Yet India will continue to be the fastest-growing economy in the world.

Source: IMF

|GlobalGiants.Com|

Edited & Posted by the Editor | 1:52 PM | Link to this Post